10 Reasons Why a Short Sale May Be Your Best Option

Upside down in your home? If you bought a property in the last few years then chances are that you are upside down and owe more on your property than it is worth. Although there are lots of options for you here are 10 reasons why a short sale may be the best bet.

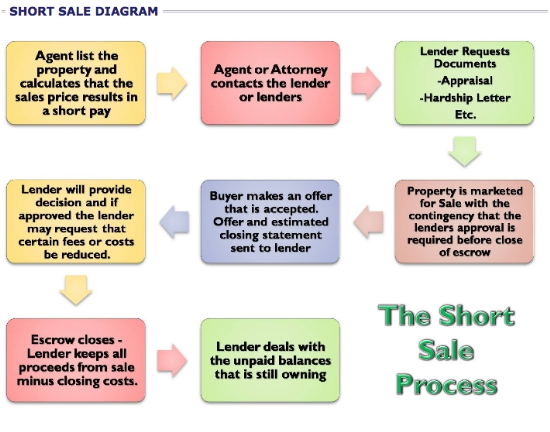

First, what is a short sale?

A short sale is when you sell your home for less than what you owe to the lender. The settlement proceeds come up “short” of the total amount needed to pay off the loan, but the bank agrees to take a loss on the sale in order to avoid costly foreclosure proceedings.

1. Save your credit – Yes, a short sale can affect your credit but it can be less threatening than a foreclosure and there is a possibility that your negotiator can get the bank to agree to report it positively to the credit bureaus.

2. Save the neighborhood – Foreclosures drive neighborhood values down drastically. A short sale is usually sold around market value so there isn’t as big of a hit to your area. Your neighbors will thank you!

3. Save your integrity – A foreclosure can be mentally devastating. It can haunt you for 7-10 years on your credit, in conversation, when applying for a loan, etc. A short sale is just that – A sale of the property! No need to explain to your friends or family why you couldn’t afford the house. Instead you made a sound business decision and got out from under a property that just wasn’t worth it anymore.

4. Save your reputation with the bank – I doubt the bank is going to turn around tomorrow and offer you a car loan but down the road the bank still wants you as a customer. Who are they going to be happy to see walk through their doors in a few months? The person who worked with them, put forth an effort to help, and allowed the bank to limit it’s losses or the person who turned and ran away and let the property go?

5. Future employment opportunities – There is no space that I’ve ever seen on an employment application asking if you’ve ever done a short sale. But if the subject of foreclosure ever comes up you might want to get another resume sent out soon…

6. Options to Buy another home in 24 months – If you do a short sale and then keep all your bills & payments current you can buy another property in just 24 short months, Maybe sooner! Fannie Mae’s newest guidelines state that as long as you can prove you can stay current they will back another loan for you in 2 years. If you get foreclosed on you are going to have to wait 5 years.

7. Options to Buy a new home immediately – How? According to Fannie Mae, if you don’t have any 60 day mortgage late on your credit report then you are eligible by their guidelines to buy a new property right away!

8. Better interest rates in the future – There usually is not a question on loan applications that reads “Did you ever do a short sale?” but I’ve certainly seen the one that asks “Have you ever had a house foreclosed on?” I’m willing to bet that those that circle the “YES” for foreclosure end up with some pretty ugly loan rates if they get approved at all.

9. Peace of Mind – It is much easier to sleep at night knowing that you did everything you could to save your house and in the end you got it sold to a new buyer, the bank got to limit it’s losses, and you are on your way to a new beginning. Sounds like good piece of mind to me!

10. Tax advantages & Cash Back (HAFA) $3,000 for borrower relocation assistance- Are you familiar with the Mortgage Debt Relief Act of 2007 & the Economic Stabilization Act of 2008? They basically state that if you short sell your primary residence between 2007 & 2013 then you may not be responsible to pay any taxes on the amount forgiven.

Buying a House after a Short Sale in 2015

buying-a-house-after-a-short-saleThere are many factors that will affect your ability to qualify for a loan in order to buy a house again after a short sale. If you have taken good care of your credit since, paid all your bills on time in the last 12 months, have money saved for down payment (as little as 3.50% to 20% down payment), and of course, you have income to qualify after a short sale, then yes, it is possible to buy a house again in as little as 12 months to 36 months after a short sale subject to certain conditions. For more information on buying a home after a short sale, please please send us a message by filling out the contact request below to tell us your specific situation. We work with a team of real estate professionals who can help make your dream of home ownership come true again.

How Long Do I Have To Wait After a Short Sale Before Buying a House?

Here are your loan options to buy a house after a short sale

Buying a House with an FHA Back to Work Program one year after a short sale with 3.5% down payment

Did you know? FHA announced on August 15, 2013 that you may only need to wait one year to be able to buy again under the FHA’s Back to Work Program. FHA is willing to back loans for borrowers with as little as 3.50% down payment after having had a short sale, bankruptcy, or foreclosure. This is subject to guidelines such as having experienced an Economic Event which is beyond your control that results in a Loss of Employment, Loss of Income or a combination of both, which causes a reduction in the your Household Income of 20% or more for a period of at least 6 months. Note: If you did a prior short sale or were delinquent on a prior FHA loan, you will not be able to buy after one year with this program using an FHA loan.

With FHA’s prior guidelines, you can buy a home immediately after a short as long as the mortgage and existing debt has zero late payments in the past 12 months. Extenuating circumstances that led to your short sale will also have to be documented such as certain hardships like job loss AND subsequent job transfer/relocation at least 2 hours drive time from prior residence, catastrophic medical bills (and/or death) incurred by a member of the borrower’s “nuclear family. Please note that divorce and relocation by themselves are not considered an extenuating circumstances unless combined with other factors such as job loss, reduction of income by more than 20% over a 6 month period, or other hardships. Please send us a message below and let us know in detail your specific situation to find out if you qualify.

Buying a House with an FHA loan one year after a short sale with 3.5% down payment with NO LATE PAYMENTS prior to short sale

You would qualify to buy again after a short sale IF you meet the following criteria: you can document a hardship, you were NOT late on your mortgage payments at the time of the short sale, proceeds from the short sale served as payment in flu for the loan, you have a clear CAIVRS report (Credit Alert Verification Reporting System), and you have an M1 mortgage credit rating for that previous account.

Buying a House with a Conventional Loan TWO years after a short sale with 20% down payment

You can buy a house after two years with a 20% down payment using a conventional loan. While waiting 2 years after your short sale, you should get to work on improving your credit rating and saving for down payment. Saving for a 20% downpayment not only helps you buy a home sooner after a short sale, but helps avoid expensive mortgage insurance on loans with less than 20% down payment. Some lenders give you the flexibility of coming up with the 20% downpayment using a combination of pledged personal assets. With Fannie/Freddie Loans, you will have to wait 4 years if you only have 10% down payment or possibly wait just 2 years if you have extenuating circumstances that lead to the short sale of your home.

Buying a House with a Conventional Loan TWO years after a short sale with 10% down payment and extenuating circumstance

You may be able to buy a house 2 years after a short sale with 10% downpayment if you can document and verify acceptable extenuating circumstances prior to your short sale. Examples of extenuating circumstances are one time events beyond your control that cause a significant and prolonged reduction in income or a catastrophic increase in your financial obligations. If you are ready to buy a home again with 10% downpayment, please send us a message below.

Mortgage after a short sale update: August 16, 2014

Fannie Mae Desktop Underwriter (DU) will change on August 16, 2014. For buyers after a short sale using conventional loan products, the waiting period will change from 2 years to 4 years after a short sale on Conventional loan products. These changes will apply on loans taken on or after August 16, 2014. For more information on how this affects your loan situation, please send us a message below. Note that the typical wait time to get an FHA mortgage after a short sale is 3 years.

Buying a House with a VA Loan TWO years after a short sale with Zero Down payment

You can buy a house after a short sale with a VA loan 2 years after completing a short sale on a prior VA loan. For some VA lenders, the waiting period after a short sale can be as little as one month if you have not been late on any mortgage payments before the final short sale and you have a 660 or better credit score. You might also qualify for an automated underwriting approval and get a VA loan. In general, VA requires a 2 year waiting period from a major derogatory event including short sale, bankruptcy, or foreclosure.

Buying a House with a VA Loan ONE year or less after a short sale with Zero Down payment

If your former loan on the home you short sold was either a VA loan or a non- VA loan, your wait time may be less than 2 years if you have a clear CAIVRS. CAIVRS is a report pulled by lenders for government loans (FHA, VA USDA) to verify that the borrower does not currently owe money to the government for previous mortgage, student loans, liens, etc. You must also document an acceptable hardship that led to the short sale such as unemployment, large medical bills not covered by insurance. Please send us a message by filling out the contact request form below to learn more information from the lenders that we work with.

Buying a house after a short sale with 25% to 30% down payment just one year after a short sale

If you do not qualify for the FHA back to work program with 1 year wait after a short sale and you have saved 25% to 30% down payment, there are lenders willing to finance your home purchase with just 1 year waiting period after a short sale. The applicable interest rates are higher on loans with a 25% downpayment compared to a 30% downpayment loan. The rates are usually fixed for the initial 5 years or 7 years on a 30 year loan until you can refinance again (usually 3 years after a short sale). Some lenders may require a minimum loan amount of $300,000 and may require a credit score of 680 with 12 months of payments cash reserves. Please fill out the contact information to receive more information from the lenders we work with.

Buying a house 3 years after a short sale

If it has been 3 years after your short sale event, you may now be eligible to buy again with as little as 3.5% down payment. Please be sure to check your credit report to confirm that the short sale was accurately reported on your credit report. Some recent inaccuracies are those of short sales being reported as foreclosures. The short sale is typically reported as settled for less than full balance. If this is not the case, i.e. it shows settled for less than full balance Chapter 5, 8 or 9 (synonymous to foreclosure) be sure to contact the creditor and get this corrected immediately.

Buying a house in 2014 after your short sale in 2010, 2011 or earlier years

Those who have completed a short sale in 2009, 2010, 2011, and earlier years are most likely ready to apply for a loan after a 3 year waiting period has passed from the date of the short sale. You may now be able to buy a home again in 2014 and apply for a loan without consideration of any special circumstances. You will want to watch the video below and read the tips below to qualify for a loan after a short sale.

Buying a house in 2015 after short sale in 2013 with extenuating circumstances

Your wait time to buy a house and qualify for a mortgage after a short sale in 2013 could only be 12 months to 24 months if you can prove that you have extenuating circumstances that led to your short sale. For example, extenuating circumstances are major illness or death of a wage earner, non-recurring situations that leads to a sudden, significant, and prolonged reduction in income or catastrophic increase in your mortgage payments and other financial obligations,. Note that divorce or a job relocation are not typically viewed by lenders as sufficient extenuating circumstances. Please send us a message below for more information.

Buying a House 4 years after a short sale in California with 10% down payment

We have good news for you if it has been FOUR years after your short sale and you are ready for homeownership again and you saved at least 3.5% down payment, please be sure send us a message by filling out the contact form request below for more information on buying a house in Florida.

Why Lenders Accept Short Sales?

• It costs lenders a fortune to foreclose a property. A short sale helps absorb additional losses and gives them immediate pay-off from the buyer.

• They are lenders, and are not in business to buy and sell real estate

• A REO (banked-owned property) is a liability, not an asset to the bank

• Most lenders are REQUIRED to have an amount up to SIX Times the retail value of each REO in reserves, so a short sale gives them an immediate relief

• Protection of their banking charter

Property Owner’s Benefits of Doing a Short Sale with Us:

• Help in Avoiding Foreclosure

• Far Less Credit Damage than Foreclosure or Bankruptcy

• Simple Relief

• Our unparalleled support includes: Real Estate Professionals, Lenders, Buyers, Consultants and more

• A Fresh Start

• You pay nothing to us upon a successful short sale transaction.

• We have a dedicated Short Sale negotiator that is in constant contact with the Lender. This ensures faster results, a better success rate and the best possible result for you!

• The lender typically pays the selling and buying agent’s commissions, general costs, past due payments, and more. The lender would need to absorb the closing costs as well.

Contact us for a free consultation! There’s no obligation and all information is strictly confidential. We NEVER charge any upfront fees for our services. There is NO COST, FEE OR CHARGE to you!