2025 Florida Legislative Session Ends With $115B Budget

- June 18, 2025

- admin

- Articles

- No Comments

New laws boost housing, eliminate the business rent tax, strengthen property rights, and improve condo transparency. Some measures still await the governor’s signature.

Budget Approval & Legislative Achievements

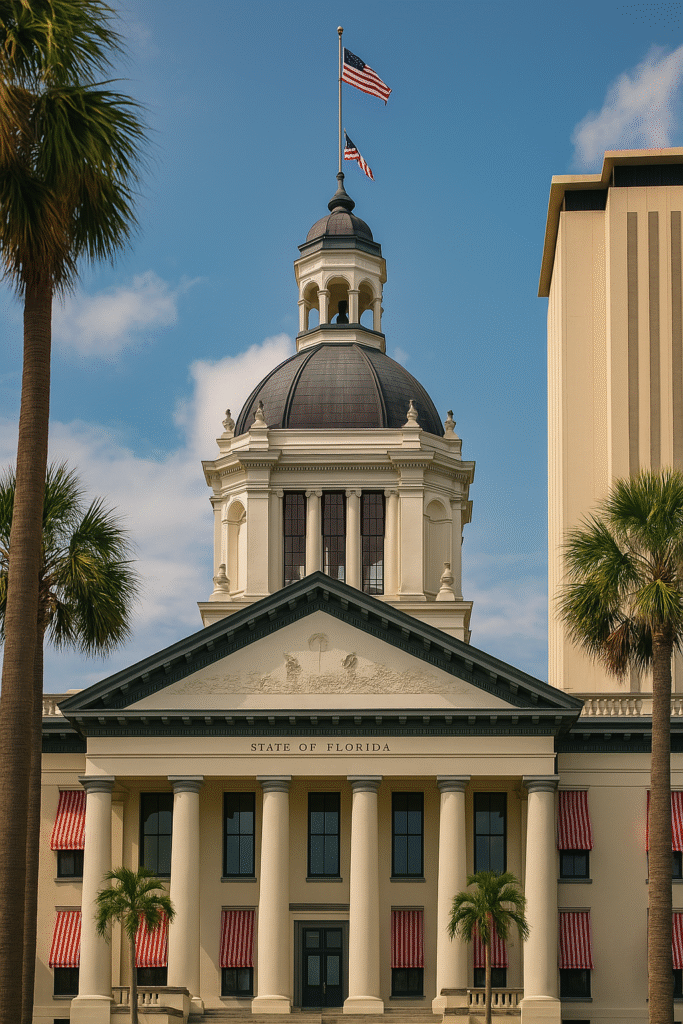

TALLAHASSEE, Fla., Florida lawmakers closed the 2025 legislative session late Monday, wrapping up an extended period focused on key budget and policy matters. The final outcome delivered a series of victories for Realtors®, property owners, and communities, including the elimination of the business rent tax and significant funding for home and condo hardening efforts.

The Legislature approved a $115.1 billion budget for the next fiscal year—$3.5 billion less than the previous year—and sent it to Gov. Ron DeSantis more than six weeks past the scheduled May 2 session deadline. The governor holds the authority to sign the budget into law, as well as veto individual bills and budget line items. The new budget will take effect July 1, marking the start of the 2025-2026 fiscal year.

“This marks the end of a long and winding road,” said House Speaker Daniel Perez, R-Miami, as the House convened Monday.

Key Wins for Florida Realtors®

The 2025 session brought major legislative priorities to fruition:

- Total elimination of Florida’s Business Rent Tax (BRT)

- $50 million for the Hometown Heroes Housing Program

- $310 million in new and unused funds to help Floridians harden their homes and condominiums

- $385 million for state and local affordable housing initiatives

- $1.5 billion for water quality and restoration projects

- Greater transparency in condominium transactions

- Protection of private property rights for commercial owners and short-term rental landlords dealing with squatters

- Preservation of Florida’s state parks and natural resources

- Elimination of negative lookback periods

- Enhanced transparency regarding flood risks for renters and property buyers

- Optional electronic notifications to improve communication between landlords and tenants

Additional Budget Measures

Lawmakers also approved tax breaks, including sales tax holidays for back-to-school items and hurricane supplies.

Other provisions in the budget include:

- $580 million allocated for state debt repayment

- $250 million mandatory annual repayment of state bonds

- Increased per-student funding in schools from $8,987.67 to $9,130.41

Proposed Constitutional Amendment

The Legislature also advanced a proposed constitutional amendment that would set aside $750 million annually, or up to 25% of the state’s general revenue, for a reserve fund that lawmakers could only access in emergencies. To take effect, 60% of Florida voters must approve the measure.

“We are doing this so that we are truly prepared for a break-the-glass situation,” said House Budget Committee Chair Lawrence McClure.

No Comments